Building the Infrastructure Behind the Future of Fixed Income: Inside TransFICC with CEO Steve Toland

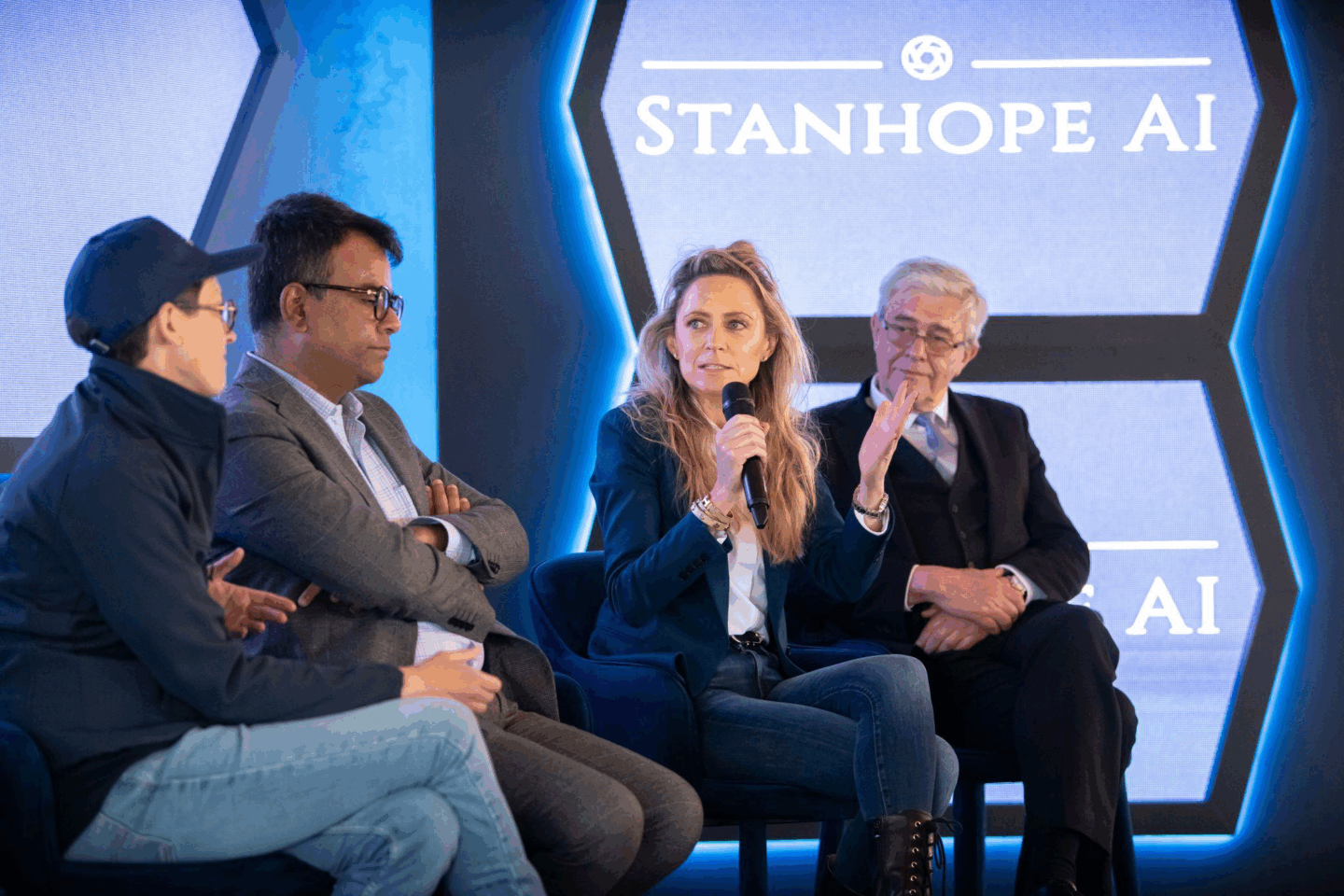

with Cat McDonald, Partner, AlbionVC

Over the past few years, TransFICC has emerged as one of the most trusted names powering the evolution of fixed income trading infrastructure. Following their $25M Series B, led by Citadel Securities, AlbionVC Partner Cat McDonald sat down with CEO and Co-founder Steve Toland to discuss the company’s journey, culture, and vision for the future.

Here are six key takeaways from that conversation.

Solving Complexity in a Fragmented Market

TransFICC was born from a direct customer insight: banks were struggling to build fast, scalable, and compliant connectivity to trading venues across the fixed income ecosystem. Legacy infrastructure was slow, siloed, and expensive. Steve and his co-founders saw the opportunity to build a modern, low-latency connectivity layer—designed to support automation in a space ripe for it.

“There were no fast, cost-effective solutions out there. The idea came from a customer who asked, ‘Why can’t someone just build this?’ So we did.”

Engineering Excellence by Design

TransFICC’s technical culture is built on rigor, collaboration, and zero shortcuts. Their use of pair programming and test-driven development (TDD) means code is written and reviewed in pairs, with tests created before any code is committed. A rotating “sheriff” monitors a live dashboard of thousands of tests to ensure nothing breaks—ever.

“We release to customers every single day—and we don’t fix bugs. That’s the result of building quality into the system from the start.”

This approach ensures exceptional uptime and has led banks to accept TransFICC’s industry-leading 99.9% SLA terms without question.

Scaling with Intention, Not Speed

While many startups chase exponential top-line growth, TransFICC has taken a different route: quality over speed.

“We’ve never doubled sales year-on-year—and that’s by design. Enterprise sales cycles are long. But we’ve never lost a customer.”

With ambitions to double headcount over the next five years, the team is scaling thoughtfully to protect their culture, technical standards, and onboarding quality. “You can’t have two new engineers start on the same day and pair with each other. There’s a natural pace you need to respect.”

Strategic Value of Long-Term Investors

Success in capital markets infrastructure isn’t built in quarters—it’s built over years of consistent delivery. That’s why alignment with long-term, patient investors has been critical.

“Some investors want AI and hypergrowth. But we needed backers who understand that banks move slowly and trust builds over time.”

Citadel Securities, Citi, and HSBC are not just funders—they’re strategic validators of the model and partners for growth.

Vision: Becoming the Infrastructure Standard

The mission is clear: become the go-to infrastructure provider for fixed income trading. Whether you’re a global bank, asset manager, or market maker, TransFICC aims to support you in:

- Connecting to venues

- Meeting regulatory requirements

- Automating workflows at scale

With deep domain expertise and a track record of high-performance delivery, the team is already gaining meaningful market share—and targeting 50% of infrastructure spend in the years to come.

A Founding Team Built on Trust and Complementary Strengths

Steve, Tom, and Judd bring together decades of experience across sales, system architecture, and engineering delivery. Their shared history at LMAX created the foundation for a company built on trust, mutual respect, and clearly defined roles. Even as the team scales past 40 engineers, the founders still personally interview every new hire.

“We’ve never outsourced engineering. You don’t do that when you’re building mission-critical software.”

TransFICC isn’t chasing a moonshot. It’s building a mission-critical foundation for the next generation of fixed income trading—one customer, one release, one test at a time. At AlbionVC, we’re proud to support companies like TransFICC that are transforming vital infrastructure through excellence, humility, and long-term vision.