European HealthTech Market Map 2025

by AlbionVC Healthcare Team

In 2025 European healthcare proves that AI is not just a buzzword, but a growth engine.

Welcome to the fourth edition of the AlbionVC HealthTech Market Map, published together with our friends at HLTH Europe. Having reviewed over 5,000 companies, we have selected just over a 1,000 high-growth startups and scaleups across digital care and digital pharma transforming European healthcare.

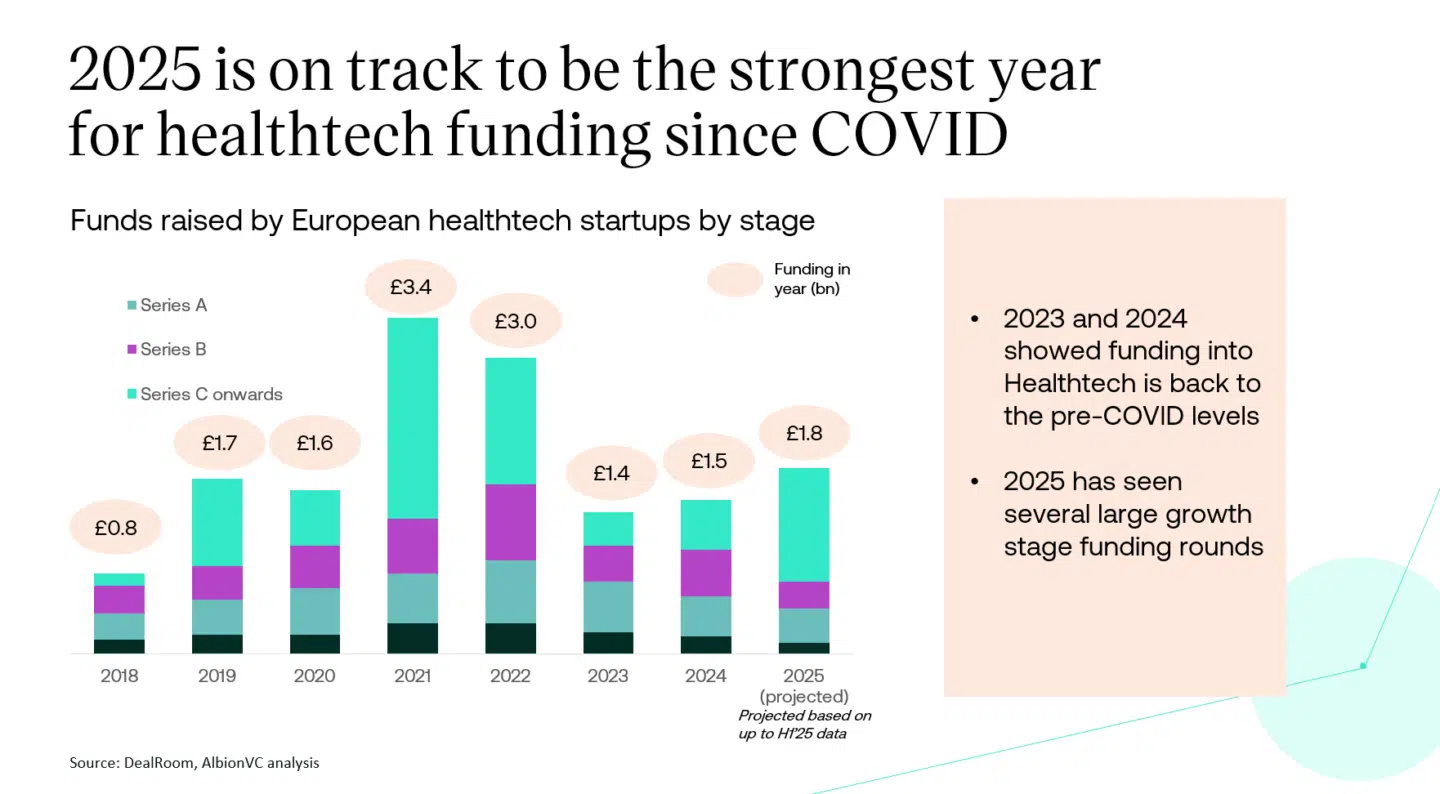

Our analysis shows that European healthtech funding is once again accelerating, driven by AI adoption. As companies continue to scale and growth capital returns, 2025 is poised to mark the sector’s strongest fundraising year since the pandemic boom.

Digital Care

Provider software and clinical decision support transformed by AI

- LLMs are streamlining clinical workflows, from provider software platforms (ambient listening and back office automation) to clinical decision support

- Over 50 new startups entered this segment in just 18 months to enable faster, more efficient care delivery and unlocking provider productivity

- We’ve also witnessed an overlap between provider software and clinical decision support segments with end-to-end automation of clinical workflows

Virtual-first care enters the market map

- Virtual-first care is a new market segment within digital care in 2025 that brings together multiple digital health services—like symptom checking, remote monitoring, teleconsultations, digital therapeutics, and chronic care management—into unified, condition-specific care pathways

- Companies in the space use technology to deliver personalised, scalable, and cost-effective care, with the goal of offering a seamless, consumer-grade healthcare experience

- Around half of these companies, especially those in specialist therapeutic areas (often requiring referral from a GP) are reimbursed via B2B (either state provider systems like the NHS or compulsory insurance companies)

- The other half are B2C demonstrating the consumerisation of healthcare. These B2C companies tend to be where quick access is a primary driver for example in pharmacy and primary care

Digital Pharma

AI for drug discovery continues to build on the 2023 momentum

- AI is accelerating drug discovery pipelines, with a wave of new entrants (25 startups) targeting previously untreatable diseases — redefining the pharmaceutical R&D model

- Within the TechBio segment, over 2/3 of the new entrants are TA (therapeutic area)-focused. This highlights the likely ‘hybrid’ business model of companies in the space – combining technology licensing with royalty structures

A more detailed analysis on the state of European healthcare in 2025 is coming soon, for now download the HealthTech Market Map 2025 here or explore the digital version below.

Connectivity & community

Consumer screening

Chronic care & companion apps

Insurtech

Provider software

Wellness

Diagnostics & clinical decision support

Remote patient monitoring

Virtual-first care

Workplace wellness

Imaging

Device enabled care

Symptom checking and triage

Teleconsultation

Workforce management

Digital operating room

Digital therapeutics

Data Aggregation

Synthetic Biology

Data Capture For Trials And RWE

Research Tools

Pricing Access & Reimbursement

Tech Bio

Digital Biomarkers

Patient Recruitment

Market Map Methodology

Criteria for inclusion of companies in the market map:

- Health technology companies (primarily software but can include elements of hardware and/or service) focused on the healthcare (providers, patients, regulators) or life sciences (pharma, medtech) industry

- Founded in 2015 or later

- With a European HQ

- Which had raised an announced institutional funding round in the last five years

- Had ten or more employees

There were several companies we identified as market leaders which we have included in the market map for completeness though these did not meet all of the criteria listed above.

Dealroom was our main database provider with additional information from Beauhurst and Crunchbase particularly around employee numbers. Data was collected in April 2025. Following this, we examined each company in turn and applied exclusion criteria to focus in on companies where software was the driver of their business.[1]

We then allocated these companies to a taxonomy based on our 2023 analysis and expanded out areas that were over-represented. Within these groups, we tried to subgroup companies operating in a similar space together to better outline the different product areas. Where companies could have existed in multiple areas, we used our best judgement based on available information. All information for categorisation was collected from websites, supplemented with knowledge within the team.

If you think you should be included on this map or would like to update the information shown, then please fill in the form here.

[1] Exclusion criteria: procurement companies, exclusively marketing or financial products for healthcare, COVID-19 testing companies, robotic surgery companies, insurance tech companies, employee benefits marketplaces, cannabis companies, industrial workplace risk management, agri-tech, veterinary tech, non informatics-based diagnostics/assays, cosmetics, supplement companies, personal trainer focused companies, devices (without user external connectivity (software in medical device), that are implantable, that are not readily mobile (new scanners etc.)), developers/tools for the development of digital health products, assay-based pathogen diagnostics, 3D printed prosthetics, therapeutic companies where software is not the core differentiator.

Technology is central to transforming European healthcare—enabling proactive, personalised, and scalable care. It’s the only path to delivering population health at scale: identifying conditions early, monitoring them more proactively, intervening effectively, and managing chronic disease more efficiently. At AlbionVC, we remain bullish about the opportunity for virtual-first care in Europe, with the potential to drive both superior patient outcomes and significant cost savings through stronger integration between health systems and startups.

Molly Gilmartin, Investment Director AlbionVC