Know how to succeed. WeAbout the team support visionary foundersFounder stories with long-term capital and scale-up expertiseHow to build.

Since 1996About us.

Sector expertise

Investment focus

Partners to early-stage software, healthcare and deeptech companies.

Sector

Company

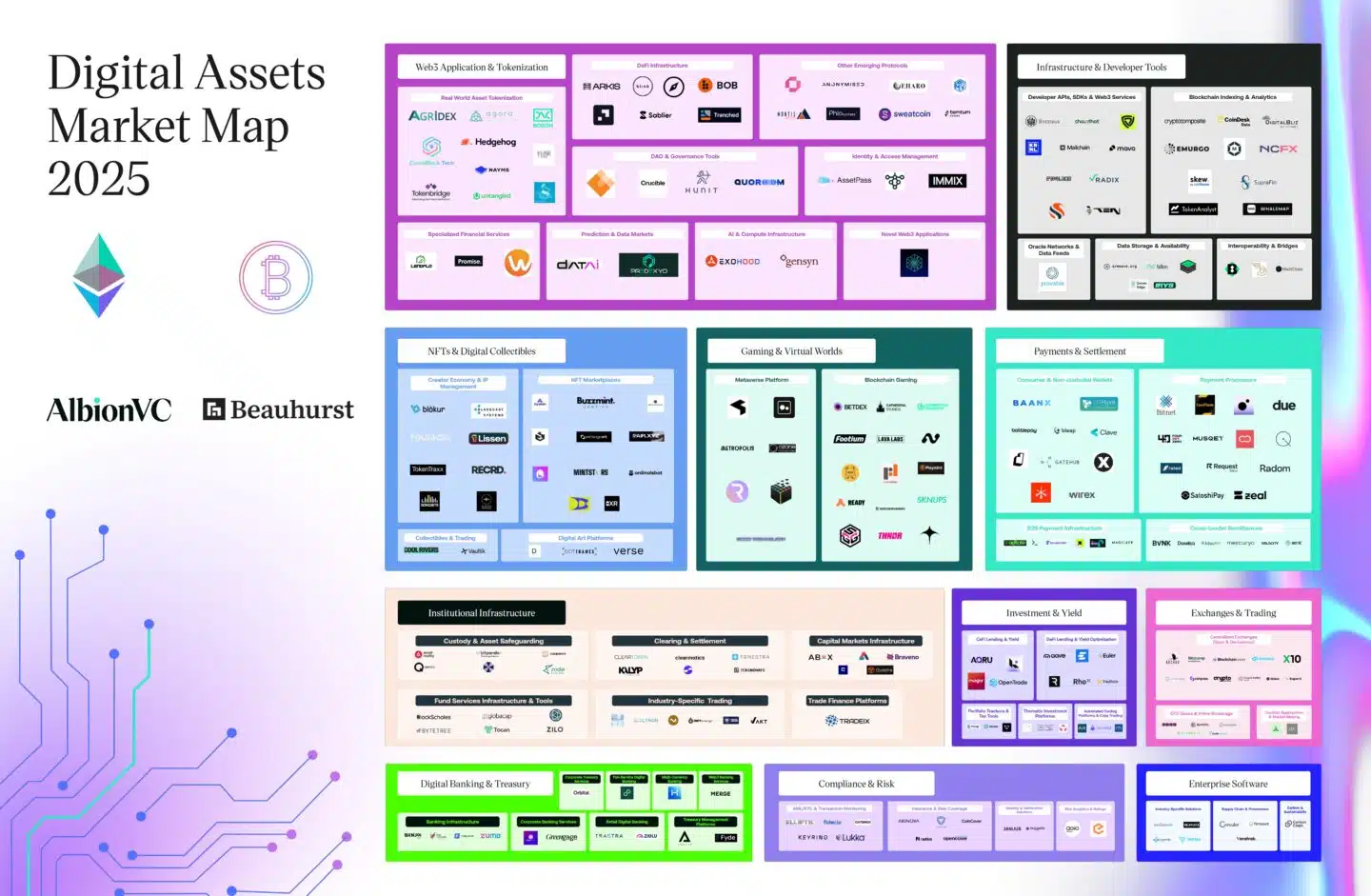

Elliptic

Blockchain analytics and crypto compliance company

Elliptic is the global leader in blockchain analytics and crypto compliance. As digital assets become embedded in the global financial system, Elliptic provides the critical infrastructure that enables institutions to participate in this market with confidence and security. With over 700 customers across 30+ countries and more than a billion digital asset transactions screened every week, Elliptic is trusted by financial institutions, regulators, and crypto innovators worldwide.

Gravitee

Next-generation API platform

Gravitee is redefining how enterprises manage APIs and event streams. Founded in 2015 by four developers, it has rapidly scaled into a global leader—earning a spot in the top category in the Gartner Magic Quadrant™ for API Management. Its powerful and flexible platform underpins the digital ecosystems of 200+ global brands, including Michelin, Roche, and Blue Yonder. Since our very first investment, Gravitee has accelerated its global expansion, driven by deep technical expertise, relentless innovation, and a sharp focus on customer success.

Oviva

Europe's leading virtual clinic for weight-related diseases

Oviva is a pioneering healthtech company transforming the treatment of diet- and lifestyle-related conditions like diabetes and obesity. By combining highly personalised clinical care with digital tools, Oviva helps people live healthier lives, reduces the burden on doctors, and drives cost savings for healthcare systems. Oviva’s approach is based on robust clinical evidence and all its treatments are reimbursed by national health insurances in Europe. To date it has helped over a 1 million patients suffering from weight-related conditions. We are proud to have supported Oviva’s journey since its seed round in 2016.

Phasecraft

The quantum algorithms company

A spinout from UCL and the University of Bristol, Phasecraft is led by world-class academics developing cutting-edge quantum algorithms to tackle some of humanity’s most pressing challenges. Since its founding in 2019, the company has achieved multiple scientific breakthroughs and built a strong syndicate of global investors. We backed Phasecraft from the very beginning and have supported them through key milestones and successive funding rounds.

Quantexa

Data and analytics company pioneering contextual decision intelligence

AlbionVC led the first round in 2017 alongside HSBC, one year after the company was founded. At the time we were highly impressed with Vishal Marria’s vision and market insights into the opportunity of unifying siloed data across the enterprise. Fast forward to today, the company has achieved a Centaur status surpassing $100m ARR. In early 2025, the company announced a $175m Series F and a $2.6bn valuation. We are delighted to continue supporting the company all the way along its funding journey.

tem

AI-driven climate tech revolutionising how renewable energy is bought and sold

AlbionVC backed tem from inception, partnering with the team as they set out to reimagine energy infrastructure with AI-native technology. Built on deep technical expertise and bold ambition, tem now facilitates energy transactions at terawatt-hour scale for thousands of UK customers. By automating and optimising energy markets, tem is making the system more efficient, resilient, and fit for a low-carbon future. AlbionVC is proud to have supported tem since day one, including the $75m Series B.

Sign-up to know what’s next

"*" indicates required fields