Digital Assets Market Map

by AlbionVC

Leading Digital Assets companies in the UK

As 2025 draws to a close, the United Kingdom stands at a pivotal inflection point for digital assets. With 23 million users—representing 35% of adults and the highest adoption rate in Europe—the UK has assembled the foundations of a mature, globally relevant ecosystem. It now has a narrow window of opportunity to turn this momentum into a lasting competitive advantage.

Our analysis of 1,426 startups over the past decade reveals a striking transformation: the UK digital asset ecosystem has evolved from a nascent, consumer-driven sector into one dominated by B2B business models—over 70% of deals done in 2025 versus just 27% in 2015. These firms are increasingly established, capital-efficient, and trusted by global customers.

The investment landscape has also matured. The inflow—and subsequent retreat—of international capital has left a market defined by extreme concentration: the top three companies raised £895m of the £2.7bn invested in UK digital asset startups over the past ten years.

As part of the research we made the decision to focus our core analysis on the companies that have raised at least $500k in equity funding. Explore the digital map of leading digital asset startups below or download the map here. Full report on the Digital Assets ecosystem here.

See the bottom of the page for methodology.

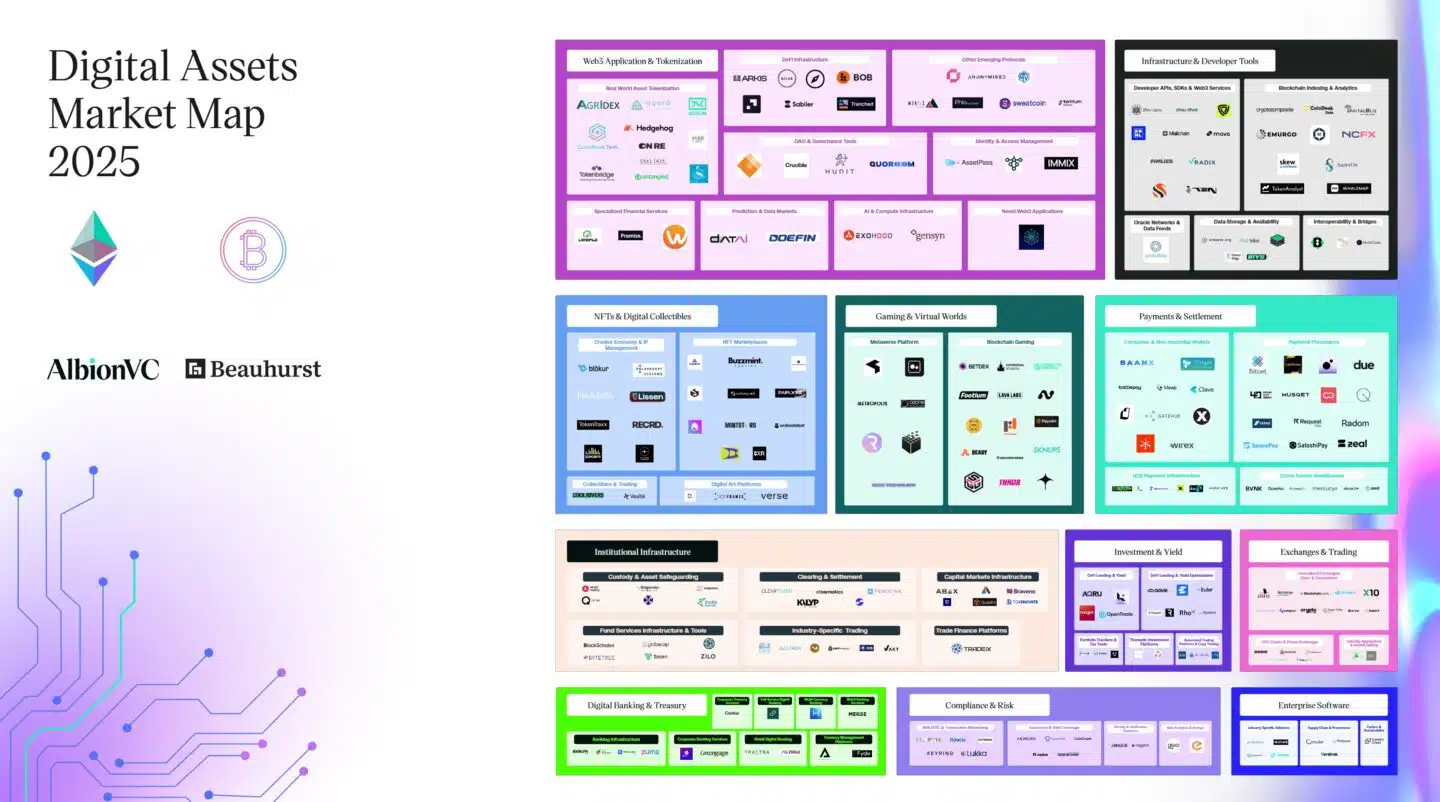

Digital Assets Market Map 2025

Web3 Applications & Tokenization

Infrastructure & Developer Tools

Payments & Settlement

NFTs & Digital Collectibles

Gaming & Virtual Worlds

Institutional Infrastructure

Investment & Yield

Exchanges & Trading

Compliance & Risk

Digital Banking & Treasury

Enterprise Software

Methodology

Criteria for inclusion of companies in the cohort has been designed in partnership with Beauhurst:

- Founded on or after 2011

- Located in the UK

- Has raised $500K in funding or more

To be included in our analysis, any investment must be:

- Some form of equity investment

- Secured by a non-listed UK company

- Issued between 1 January 2015 and 30

June 2025

All information for categorisation was collected from websites, Beauhurst data and supplemented with knowledge within the team.

If you think you should be included on this tracker or would like to update the information shown, then please fill in the form here.

“We continue to see a significant opportunity

Kibriya Rahman, Investor AlbionVC

for digital-asset-native companies to build the

critical infrastructure connecting TradFi and

digital assets. Our 2025 investment in Agio

Ratings, a best-in-class risk management

platform for digital assets designed for banks,

funds, and insurers, underscores our thesis:

institutional adoption will be driven by trust,

transparency, and robust infrastructure.